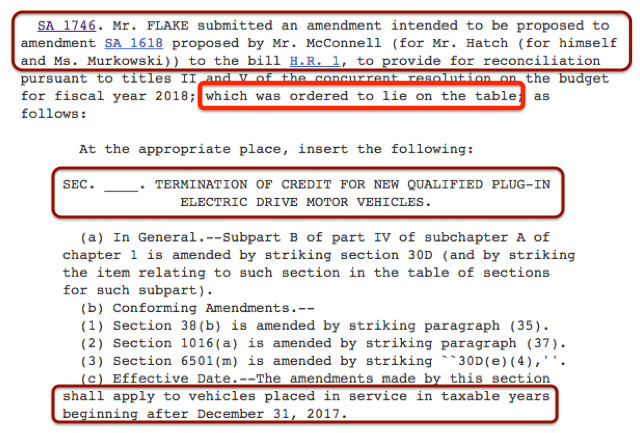

ev tax credit bill text

Congress is poised to fix the most annoying thing about buying an electric car The new EV tax credit would be 12500 and refundable. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year.

Electricity Bill For Electric Car Off 73

Its good news for General Motors which recently begged the government.

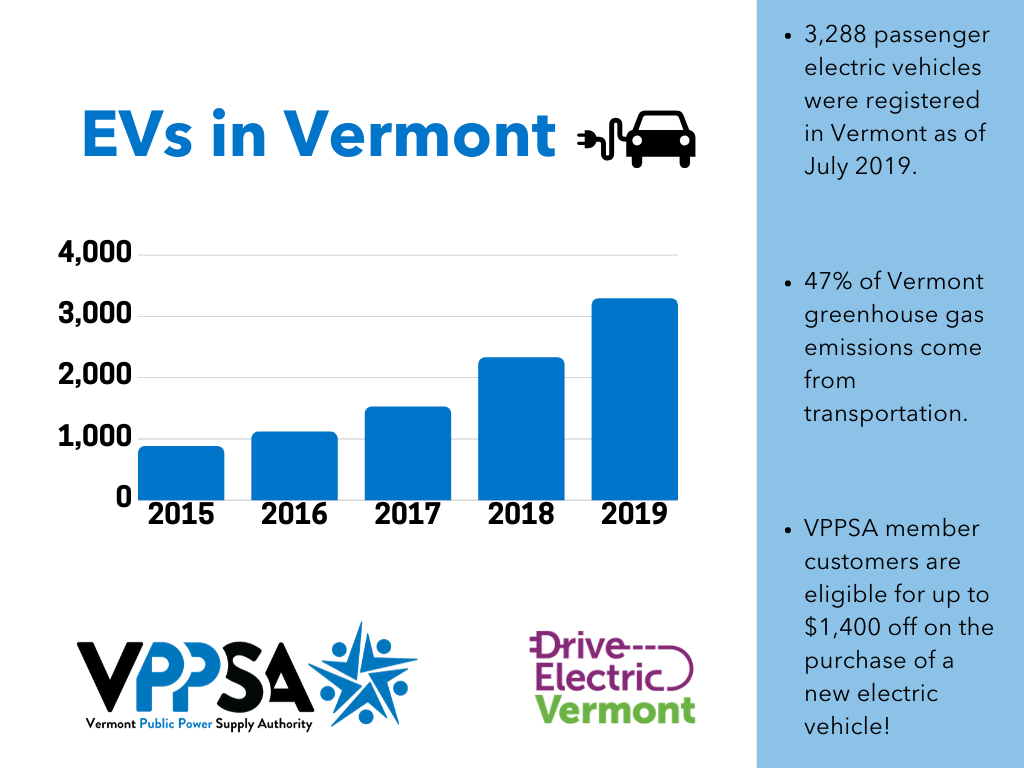

. Electric vehicles The bill would provide 75 billion for zero- and low-emission buses and ferries aiming to deliver thousands of electric school buses to districts across the country according to the White House. As more electric vehicles reach dealer showrooms EV tax credits are stuck in a legislative limbo. Now as part of a massive 35 trillion reconciliation spending bill the credit faces an uncertain future.

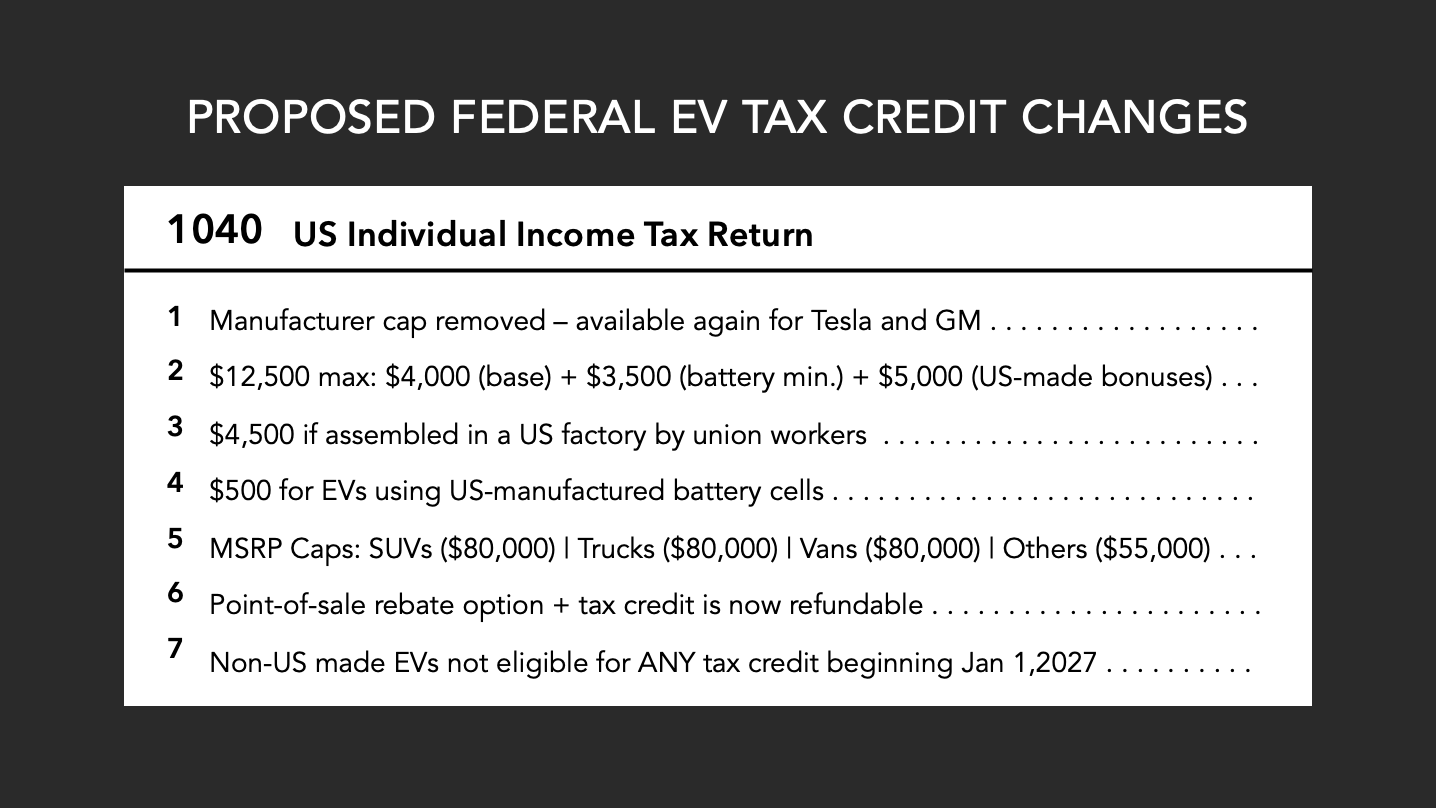

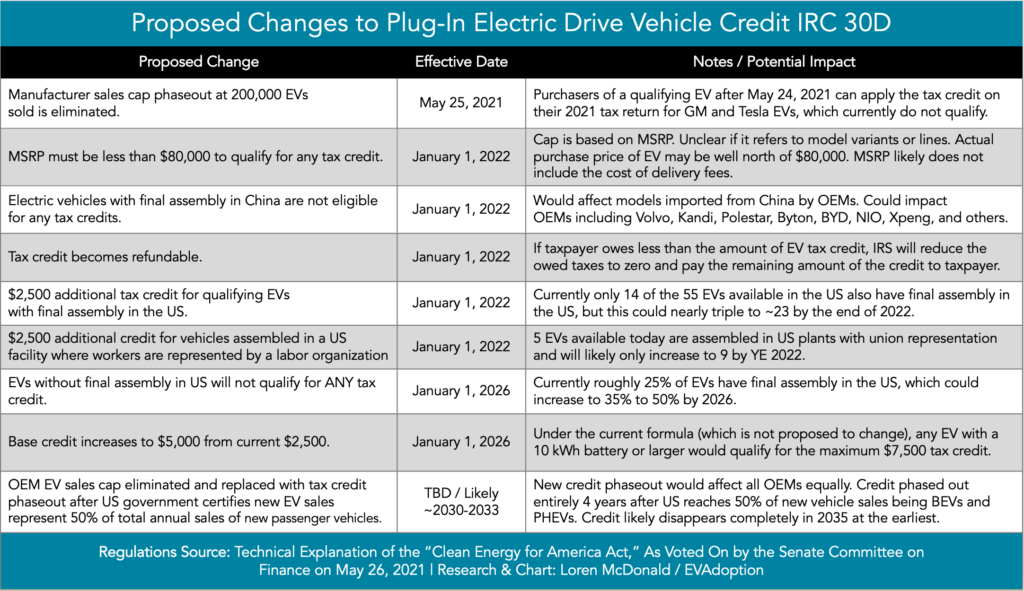

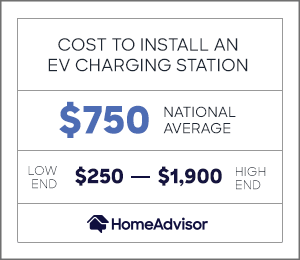

The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. Another 75 billion would go to building a nationwide network of plug-in electric vehicle chargers according to the bill text. Add an additional 4500 for EVs assembled in.

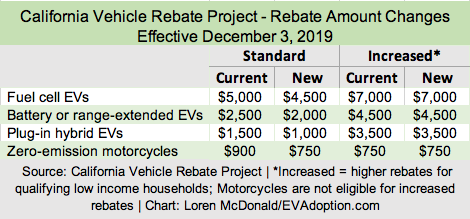

An expansion of the EV tax credit. The likelihood that the reconciliation bill does not at least include an extension of the basic 7500 EV tax credit are slim it is central to Bidens and Schumers agenda to boost EVs and lots of Democrats are pushing for it as evidenced by multiple tax credit bills considered in the senate the last few months. Dan Kildee D-Mich would extend the 7500 EV tax credit through 2031 but limit it to sedans costing less than 55000 while price tags for vans SUVs and pickup.

The tax credits mesh with the EV infrastructure plans contained in the hard-infrastructure bill already passed by Congress and throw cold. Increasing the base credit amount to 4000 from 2500 is fine. 4000 Base Tax Credit.

Current EV tax credits top out at 7500. 23 2 After the application of the nonrefundable credits in subsection 1 of this section 24 the nonrefundable personal tax credits against the tax imposed by KRS 141020 25 shall be taken in the following order. On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals.

Changes include raising the federal EV tax rebate ceiling to 12500 and opening the door for automakers who already exhausted their production quotas. The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. If this works out it could be a huge boon to the auto industry.

It would limit the EV credit to. Keep the 7500 incentive for new electric cars for 5 years. There is no tax credit if you decide to lease a.

This bill would allow a credit against those taxes for each taxable year beginning on or after January 1 2017 and before January 1 2020 in an amount equal to 10 of the costs paid or incurred by the taxpayer for the purchase of electric vehicle infrastructure as defined during the taxable year for use at a qualified dwelling as defined not to exceed 2500 as specified. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. EV Tax Credit Bill Faces Opposition from Tesla Toyota and Republicans Decrease Font Size Increase Font Size Text Size Print This Page Send by Email Pro-EV pro-union bill accused of favoring Big.

The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if. Meanwhile Republicans on the senate managed to draft a bill that kept both in place. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers.

Bill Text 2022-03-03 Provides corporation business tax credit and gross income tax credits for purchase and installation of certain electric vehicle charging stations. However it doesnt mean theyve been forgotten. The way this works is that in the initial draft of the 15 trillion House tax bill the 7500 electric-vehicle tax credit and the wind production tax credit would both be eliminated.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the. 21 z The electric vehicle infrastructure tax credit permitted by Section 1 of this 22 Act. Heres how you would qualify for the maximum credit.

Federal tax credit for EVs jumps from 7500 to 12500. The expanded credit earlier in. B Limitation.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to. Build Back Better Act. As mentioned below however the 10 kWh battery.

Introduced in the Senate Referred to Senate Environment and Energy Committee. The bill introduced by Rep. The White House has touted the tax credit as something that will lower the cost of American-made electric vehicles for middle-class families.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. Text for HR5376 - 117th Congress 2021-2022.

Electric Vehicle Tax Credits Rebates Snohomish County Pud

A Fleet Manager S Guide Electric Vehicle Tax Credits

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Legislation Regulations Evadoption

Legislation Regulations Evadoption

Ev Federal Tax Credit Electrek

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How Much Does Your Electric Bill Go Up With An Electric Car Off 72

Legislation Regulations Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Plug In Electric Vehicle Policy Center For American Progress

Electricity Bill For Electric Car Off 73

Electricity Bill For Electric Car Off 73

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

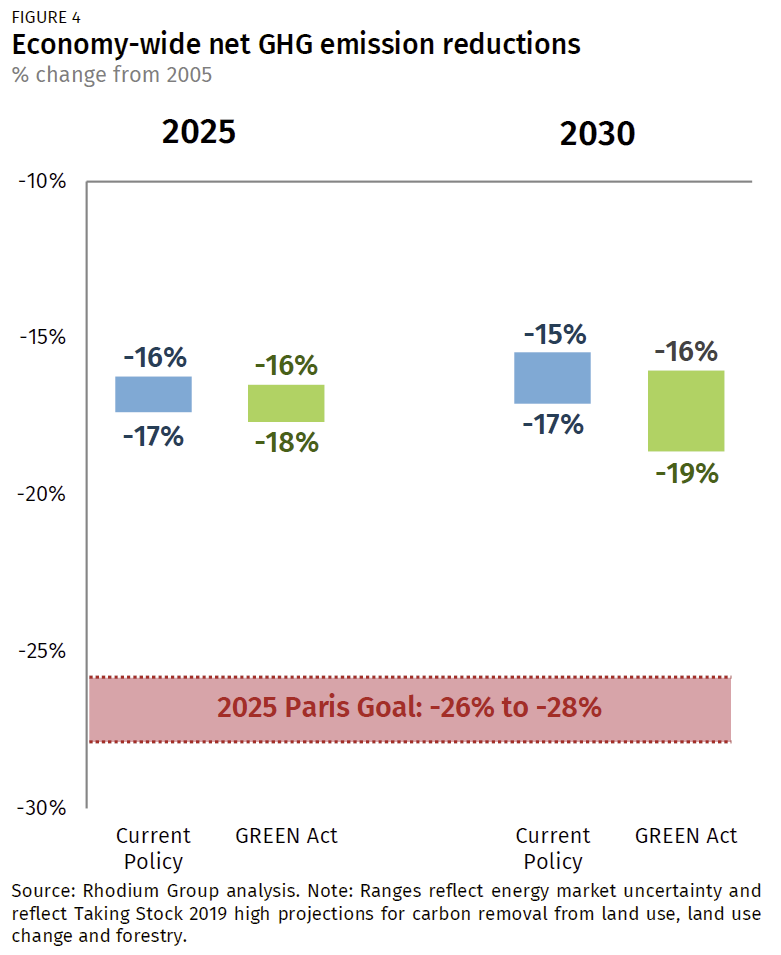

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group